knoxville tn state sales tax

400 Main St Room 453. 4 rows Knoxville TN Sales Tax Rate.

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

The general state tax rate is 7.

. The local tax rate may not be higher than 275 and must be a multiple of 25. The local sales tax rate and use tax rate are the same rate. Tax Sale 10 Properties PDF Summary of Tax Sale Process and General Information.

3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. 2022 Tennessee state sales tax. We will contact businesses submitting the application by fax or email at the telephone number you list on the application and you may then provide creditdebit card information for the transaction.

Sales Tax Knoxville 225. The Knoxville sales tax rate is. Get email updates for new Tax Compliance Manager jobs in Knoxville TN.

TN Sales Tax Rate. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. What is the sales tax rate in Knox County.

Purchases in excess of 1600 an additional state tax of 275 is added up to a. From July 1 2022 until June 30 2023 gun safes and safety equipment are sales-tax free and from. When are Tennessees sales tax holidays.

Bridges Business Cemeteries Climate Cost of Living Crime Education Employment Facilities Finance Government. The 2018 United States Supreme Court decision in South Dakota v. The minimum combined 2022 sales tax rate for Knoxville Tennessee is.

The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Tax sale dates are determined by. In the state of Tennessee sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Liquor-by-the-drink licensees may offer drive-through pickup carryout and delivery orders of alcoholic beverages for consumption off the premises until July 1 2023. The minimum combined 2022 sales tax rate for Knox County Tennessee is. Review information presented on state sales and use tax returns before during and after preparation.

State Sales Tax is 7 of purchase price less total value of trade in. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in. The Knox County sales tax rate is.

The sales tax is comprised of two parts a state portion and a local portion. A tax district like the one in mind for the Knoxville stadium uses new tax revenue created by new investment and development to help pay for public infrastructure and other improvements within the. The Tennessee state sales tax rate is currently.

Monday August 1 Wednesday August 31 Food food ingredients and. Local Sales Tax is 225 of the first 1600. Hendersonville TN Sales Tax Rate.

Friday July 29 Sunday July 31 Clothing school supplies and computers. The current total local sales. 3750 with affidavit of counseling.

9750 without affidavit of counseling. The 15 liquor-by-the-drink tax should be collected on these off premises sales. The tax should be collected from the consumer of the beverage.

Apply today at CareerBuilder. Last item for navigation. Sales Tax State 700.

Local sales and use taxes are filed and paid to the Department of Revenue in the same manner as the state sales and use taxes. This amount is never to exceed 3600. All local jurisdictions in Tennessee have a local sales and use tax rate.

For example if you buy a car for 20000 then youll pay 1400 in. Add Business Partner Affidavit PDF Amusement Tax Report PDF Business Tax License Application PDF. This is the total of state and county sales tax rates.

Sales Tax Tn information registration support. This means that an individual in the state of Tennessee who. 400 Main St Room 453.

As reported by CarsDirect Tennessee state sales tax is 7 percent of a vehicles total purchase price. Exact tax amount may vary for different items. 3 Page 1099-K Filing Requirement 29.

Local collection fee is 1. Several examples of of items that exempt from Tennessee sales tax are medical supplies certain groceries and food items and items used in packaging. Local Sales Tax is 225 of the first 1600.

Last item for navigation. Germantown TN Sales Tax Rate. Job posted 6 hours ago - KPMG is hiring now for a Full-Time Senior Manager State and Local Tax - Sales and Use Compliance in Knoxville TN.

Tennessee sales tax holidays 2022. 2022 Tennessee state sales tax. This weekend is one of three tax-free periods.

Ad New State Sales Tax Registration. Youll then get results that can help provide you a better idea.

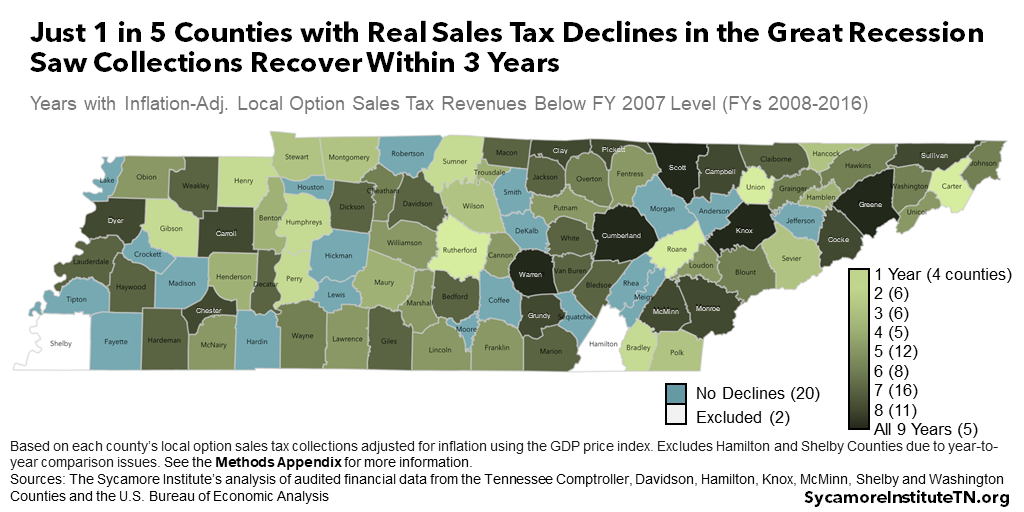

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

All You Need To Know When Moving To Knoxville Tn College Hunks Hauling Junk Moving

Vol Walk Tax Slayer Bowl Tennessee Volunteers Football Rocky Top Tennessee University Of Tennessee

Free 16 Boutique Business Plan Templates In Pdf Ms Word

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Airbnb Will Start Collecting Lodging Tax In Knoxville Tennessee